[et_pb_section fb_built=”1″ _builder_version=”3.11.1″ background_color=”#eeeeee”][et_pb_row use_custom_width=”on” custom_width_px=”960px” custom_padding=”|20px||20px||true” _builder_version=”3.11.1″ background_color=”#ffffff”][et_pb_column type=”4_4″ _builder_version=”3.11.1″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.11.1″ text_font=”||||||||” text_font_size=”18px” text_line_height=”1.4em”]

Woodford Research presents

How to Reap Huge Profits

Following Insiders

Pre-Launch starts October 8th

On October 8th, 2018, a very special webinar will take place.

Millions of dollars will be made.

And we want you to take home as much of that loot as possible.

If you’re reading this, you have been invited to join an exclusive group – a network of trusted affiliates with whom we have close personal relationships.

We want each of you to make a giant pile of cash. Because when you make money, we make money.

And let’s be honest… we’re all just looking out for #1.

Over the last 12 months, we built, tested and refined a product launch for one of the most “sellable” trading strategies we have ever seen.

It’s simple. It is academically proven to work. And frankly… it just makes sense.

I’m talking about following insiders. Think about this…

If the CEO, the Vice President, and the Chairman of the Board all bought huge chunks of their company’s stock… in their personal accounts… at the same time… and completely out of nowhere…

Do you think they might know something?

Would that be valuable information to you, as a trader?

You’re damn right it would!

After all, who better to get a “tip” from than the men and women who know that company the best? The one’s running it!

What if the CFO suddenly bought $2,000,000 of stock right before a major earnings announcement? Would that make your spidey senses tingle?

I hope so! He’s literally the one filling out the earnings report!

Why would he POSSIBLY invest his own money unless he knew good news was coming?

It’s such a simple concept.

You grasped it already. And buyers take to it immediately.

Sales Figures

Internal Launch (WARM traffic)

Opt-In Rate: ?

Webinar Attendance: 43.0%

Conversion Rate: 17.8%

Took Up-Sell Offer: 19.1%

Average Cart Value: $1,683

(We have since raised the price by 33% and seen no drop in conversions)

Affiliate Traffic (SEMI-WARM traffic)

Opt-In Rate: ?

Webinar Attendance: 32.0%

Conversion Rate: 11.25%

Took Up-Sell Offer: 15.7%

Average Cart Value: $2,078

Important Dates

Hotlist Build:

October 8th – October 14th

Webinar Event:

October 15th @ 8:00pm ET

Follow-Up Campaign:

October 16th – October 29th

What You Need to Know About

“Insider Trading”

#1 Yes… it’s legal.

Thanks to an SEC loophole known as Rule 10b5-1, company insiders are allowed to buy and sell their own company’s stock.

But they are required to report their trades. We track these obscure filings to discover “insider” buying opportunities.

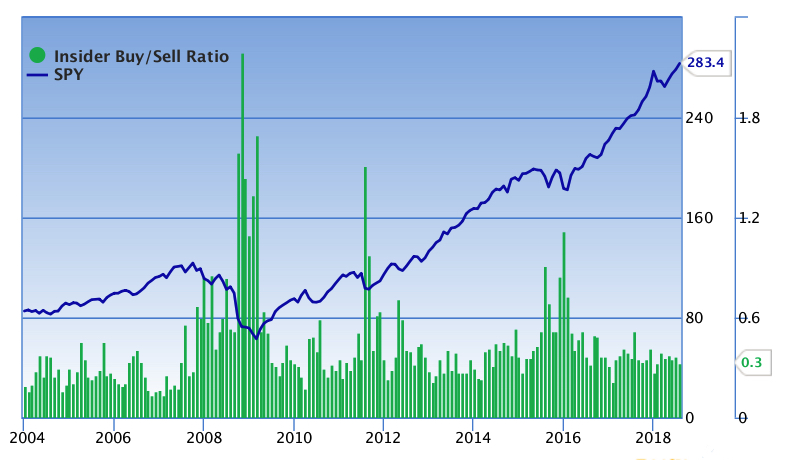

#2 It works.

A Wharton School of Business study concluded that…

“investors can reap ‘exceptional’ profits by imitating insiders.”

A similar study from Harvard Business School found …

“When a top insider buys his or her company’s stock, it rises by an average of 31% in the next six months.”

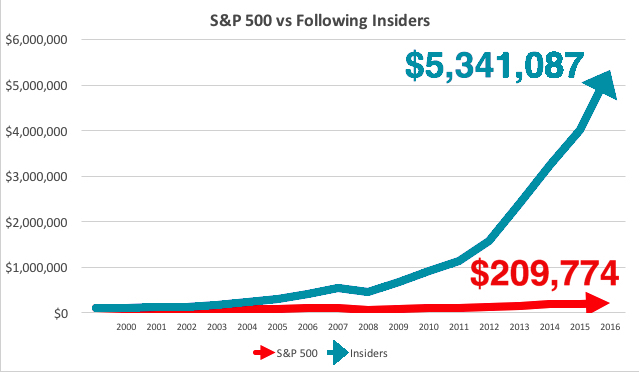

They also determined that following opportunistic insider trades would have returned an additional 21.6% annualized rate of return over the market since 2000.

Hypothetical Growth of $100,000

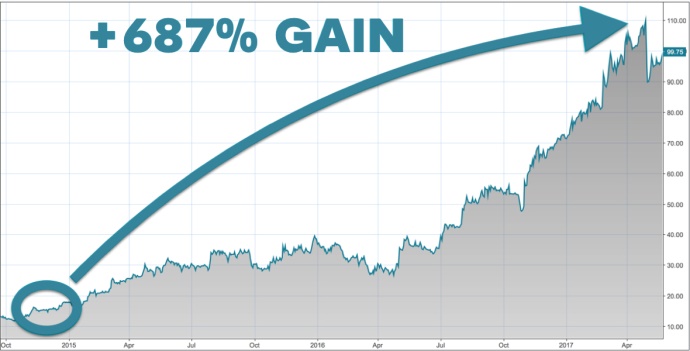

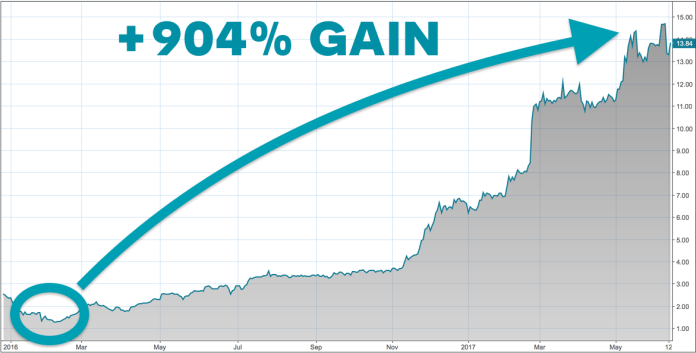

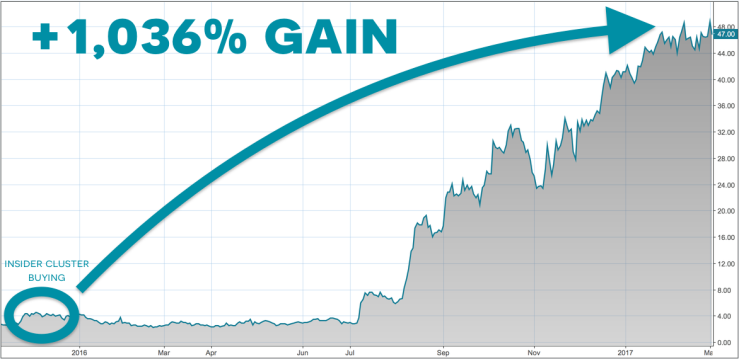

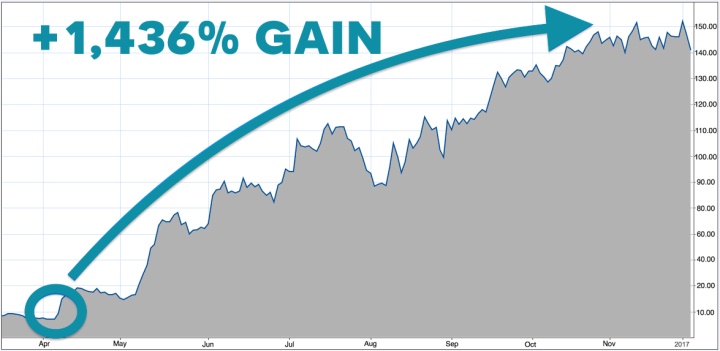

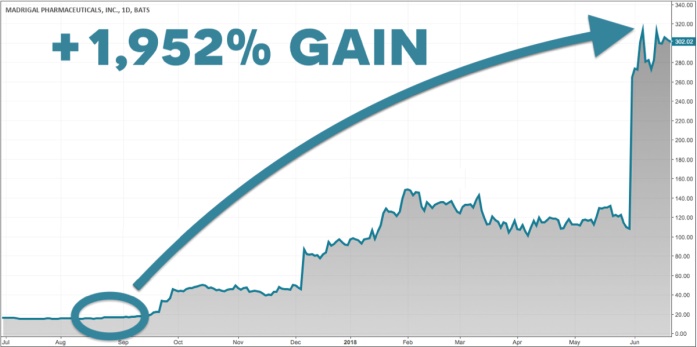

Following insider buying has led to enormous gains. For example:

Heska

Kemet Corp

Resolute Energy

CRH Medical

Clayton Williams Energy

Madrigal Pharmaceuticals

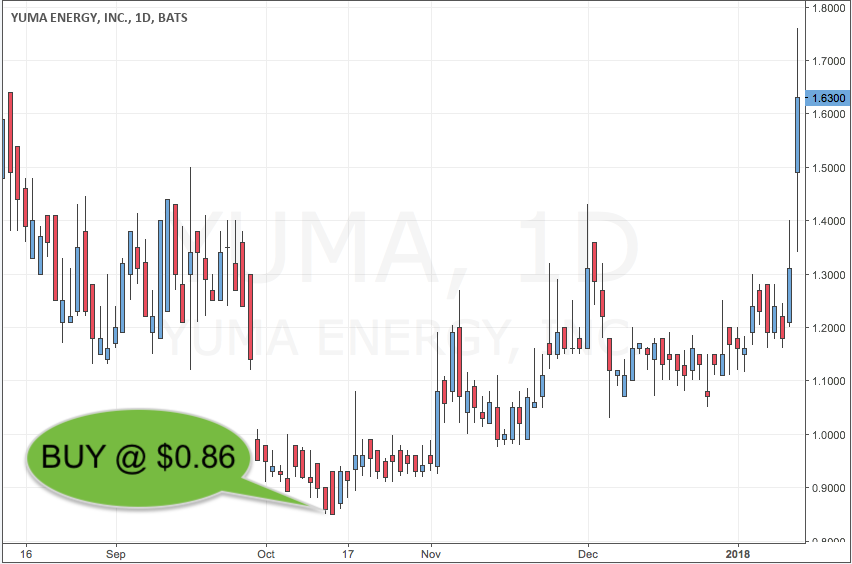

#3 They have impeccable timing.

Insiders regularly buy near the lows or just before big moves higher.

It’s easy to see why. They have access to non-public information that gives them an enormous edge.

Here’s how the Champions Oncology CEO traded his stock after its IPO:

For decades, CEOs have outperformed the market. Some estimate insiders beat the average investor by more than 15-fold.

And several of the Insider Report picks have piggybacked their impeccable timing:

#4 There’s no lag time.

Insiders must report their trades within 48 hours. So unlike hedge funds who can wait more than 3 months to reveal their trades, we see what insiders are buying almost immediately.

Subscribers love getting “inside tips” about the CFO who just bought 50,000 shares YESTERDAY.

Track Record

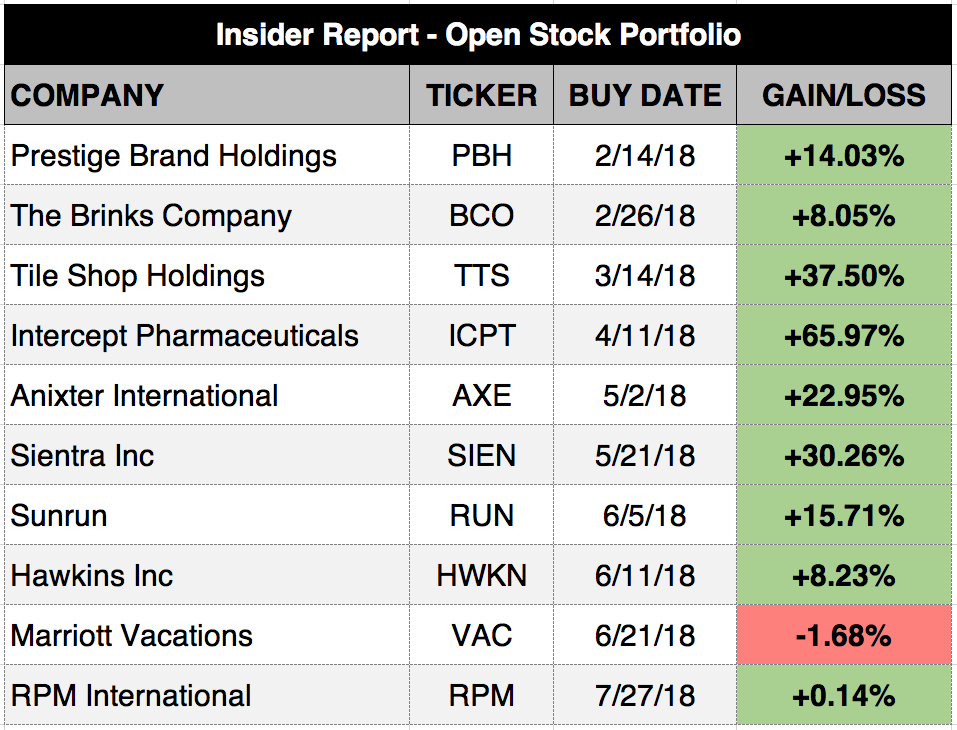

Below is the Insider Report open stock portfolio as of August 8th:

With an average holding period of just 3 months, open positions represent a 75.48% average annualized stock gain.

All recommendations include an simple, easy-to-follow option trade as well (unless the stock is not optionable).

The option track record has been ever better than the stock. Subscribers regularly book gains of several hundred percent with basic call options.

Presenters

Ross Givens is a former broker, wealth manager and securities analyst. He has appeared on CNBC, Fox News, Bloomberg Television, Arise and BNN.

Ross Givens is a former broker, wealth manager and securities analyst. He has appeared on CNBC, Fox News, Bloomberg Television, Arise and BNN.

Before launching the Insider Report newsletter, Ross was a multi-million dollar copywriter for the leading financial publisher in the world, Agora, Inc.

Hubert Senters has been a trader for more than 20 years, specializing in technical analysis. His frank, “Kentucky boy” personality make him one of the most loved educators in the investing niche.

Hubert Senters has been a trader for more than 20 years, specializing in technical analysis. His frank, “Kentucky boy” personality make him one of the most loved educators in the investing niche.

He is the President of HubertSenters.com where he and his experts have been featured on CNBC, CNN, Forbes, The Street, and many others.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]